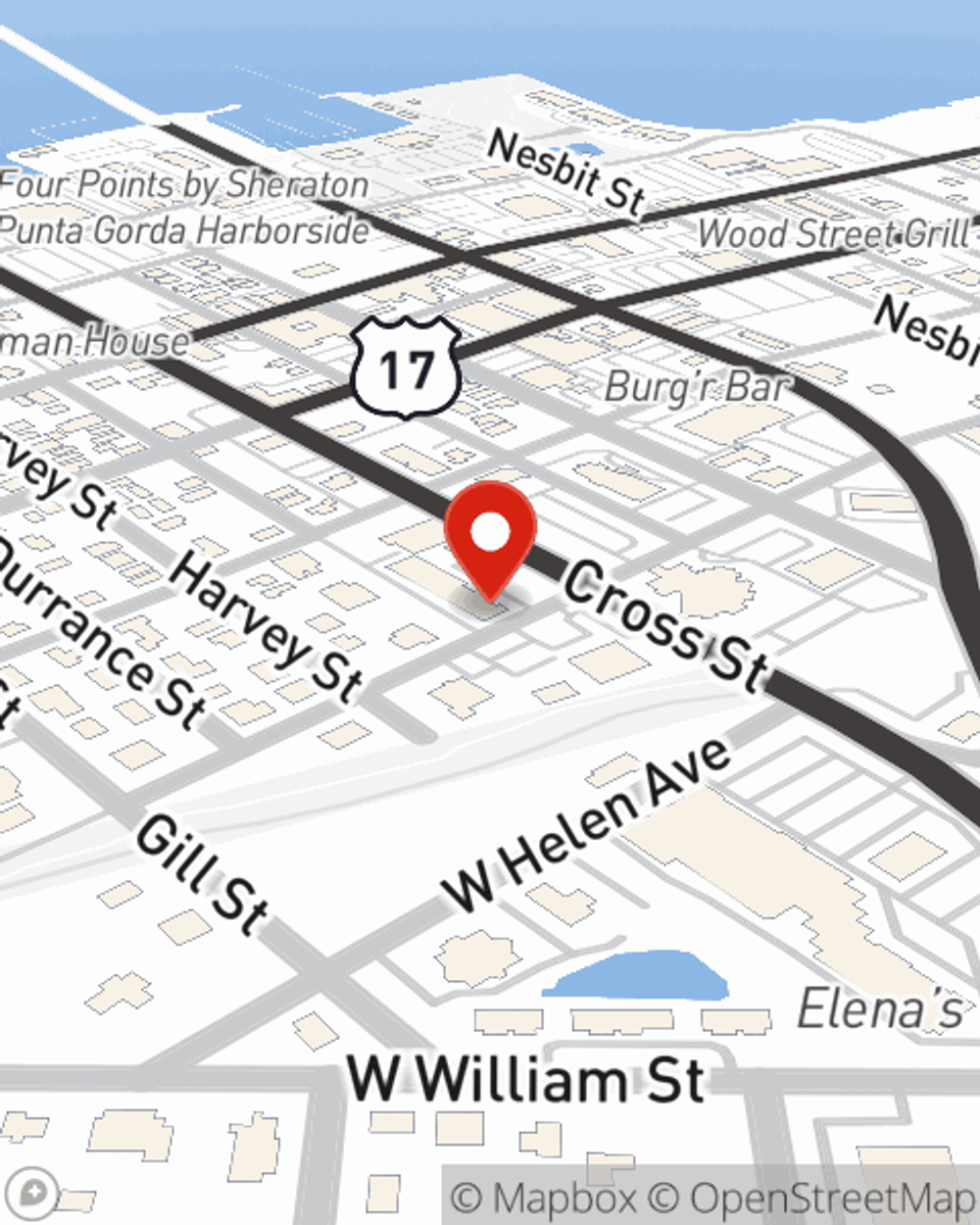

Life Insurance in and around Punta Gorda

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

Think you are too young for life insurance? Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Punta Gorda, FL, friends and neighbors of all ages already have State Farm life insurance!

Insurance that helps life's moments move on

Now is the right time to think about life insurance

Put Those Worries To Rest

Life can be just as fickle when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific number of years or coverage for a specific time frame, State Farm can help you choose the right policy for you.

No matter what place you're at in life, you're still a person who could need life insurance. Get in touch with State Farm agent Mike Martin's office to explore the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Mike at (941) 505-2550 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Mike Martin

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.